Materiality of Topic

The finance sector faces a growing demand from society to exert its influence through business activities such as investment. Financial authorities have prepared a recommended standard for green finance to nurture a voluntary green ecosystem in the domestic financial sector. The TCFD calls on companies to analyze and share the financial impact of climate change on business.

Hanwha Life's Management Approach

We have established an eco-friendly management system as part of our efforts to internalize environmental protection and green corporate management, for which we have acquired ISO14001 certification. In addition to declaring our commitment to coal-free finance, we are now implementing a range of educational programs and campaigns to increase environmental awareness across the company.

In April 2021, Hanwha Life joined the TCFD, a consultative body on financial information disclosure, and in line with its guidelines, we are analyzing the financial impact of climate change, including a variety of risks and opportunities. We are also transparently disclosing key information along with related information and climate response activities to our stakeholders.

Sustainability

Hanwha Life is committed to sustainable management and

shared growth with all stakeholders.

Sustainability

Sustainability of Hanwha Life

Adding value to the lives of our customers, Your steadfast partner, Hanwha Life

Hanwha Life established in 1946, is the very first life insurance company in the Republic of Korea and it has led the development of the insurance industry and protected the health and happiness of Korean citizens. Based on our strong customer-centered management philosophy and our own unique competitiveness, we are expanding the value of insurance to enrich the lives of customers and further fulfill our corporate social responsibility as we grow alongside our stakeholders.

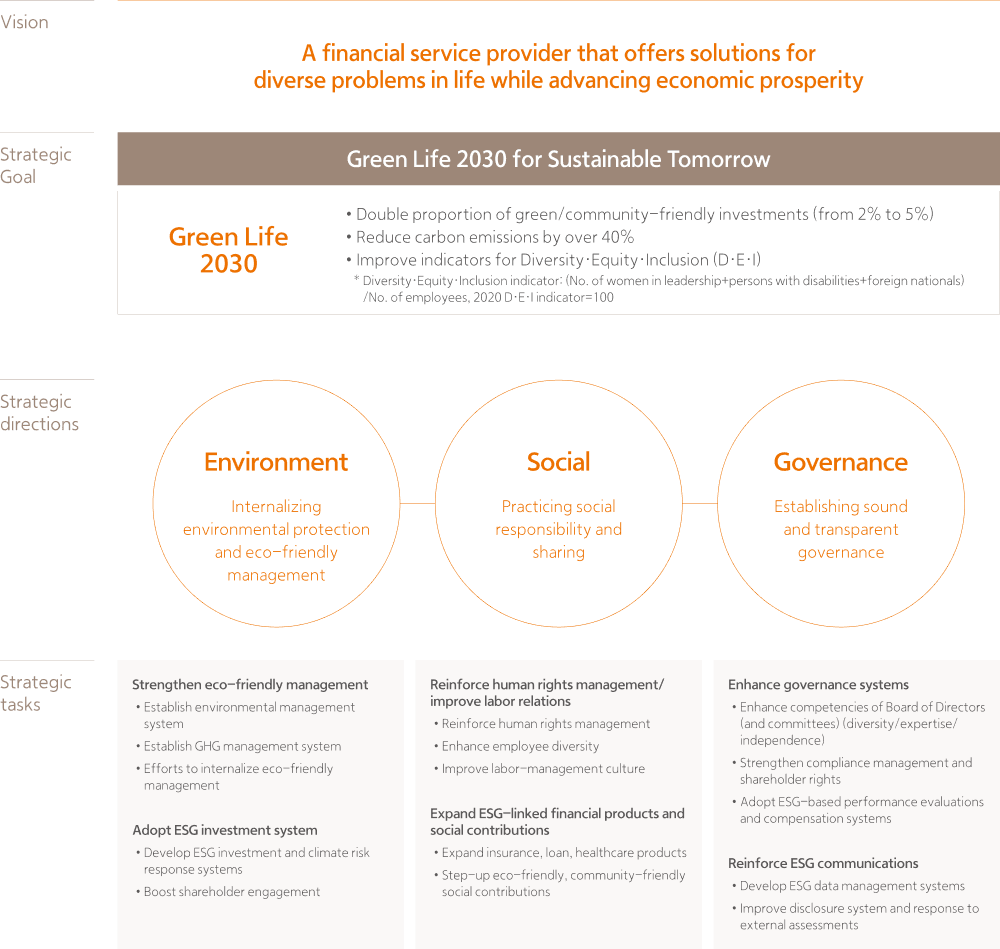

ESG Strategy

We have established and are working to implement an ESG management strategy for 2022. Our ESG strategic goal of “Green Life 2030 for sustainable tomorrow”, includes three strategic directions: “Internalization of environmental protection and eco-friendly management”, “Practicing social responsibility and sharing”, and “Establishing sound and transparent governance”. Under these three strategic directions, we have identified strategic tasks for our efforts to promote ESG management and create ESG value.

Environment

Internalizing Environmental Protection and Eco-friendly Management

Green finance is rapidly emerging as a critical agenda for the financial industry, as abnormal temperatures and global warming continue to damage the world’s ecosystems, underscoring the ever-growing importance of climate action. In this context, we have established an eco-friendly management system in order to internalize green business practices across the company. We have also joined the Task Force on Climate-related Financial Disclosures (TCFD, a consultative body for climate change-related information disclosures), and we publish relevant climate-related information according to its recommendations.

Social

Practicing Social Responsibility and Sharing

Companies grow and flourish symbiotically through interactions with a diversity of stakeholders. Stakeholders are challenging companies to look beyond economic value, and take active part in addressing social issues. In the insurance industry, where we engage closely with stakeholders in different stages of their lives, we are building a foundation for sharing and co-prosperity as our corporate social responsibility.

Materiality of Topic

Businesses are being called on to take more assertive action to fulfill their corporate social responsibility. They are expected to actively engage with the communities in which they operate and strive to resolve social issues. Hanwha Life in particular, as a major insurer, is directly and indirectly connected to the everyday lives of all stakeholders, from customers to local communities, employees, and business partners. Therefore, we should do our own business in a way that prioritizes their needs.

Hanwha Life's Management Approach

Hanwha Life pays earnest attention to the voices of all stakeholders, from local communities to customers, employees, and business partners, and makes a variety of efforts to ensure their well-being. We are promoting inclusive financial products and services to expand insurance access for socially vulnerable groups; ESG products that address health and social problems, and ESG investment, innovation and finance for co-prosperity. We have also established an advanced consumer protection to enhance customer satisfaction along with many other efforts to fulfill our corporate social responsibility by sharing with local communities.

Governance

Building Sound and Transparent Governance

To maintain and grow the company in a rapidly changing business environment, we recognize the need to establish a sound governance structure and management system. With the growing importance of ESG management, it is also critical to control non-financial risks. To this end, we formed a balanced Board of Directors and a number of committees under the Board, including the Sustainability Management Committee, to move business forward and make decisions in the interests of our stakeholders, particularly shareholders and customers. In addition, by establishing a robust management system, we have sought to identify and manage both financial and non-financial risks in a proactive manner.

Materiality of Topic

The Board of Directors, as our highest decision-making body, deals with matters concerning business strategy and the company’s long-term growth.

The sound make-up and transparent operation of the Board is fundamental to ensuring long-term business continuity. Furthermore, because the ethical standards of the company determine its reputation, particularly in the financial sector, it is critical that we maintain customer trust by putting in place reliable systems to manage risks and protect customer data.Hanwha Life's Management Approach

We seek balanced decision-making by maintaining independence and diversity on the Board. In 2021, we created our Sustainability Management Committee to lay the foundations for ESG management, and in 2022, we have updated and adopted our “Corporate Governance Charter.” We have drafted and distributed ethical management policies and are striving to create an enterprise-wide culture of ethics and compliance. Furthermore, equipped with a risk management system for both financial and non-financial risks, we are pre-empting the uncertainties and potential losses that could occur as we do business in a rapidly changing financial environment.

ESG Evaluation

Excellence of Hanwha Life's ESG performances is recognized by ESG evaluation agencies.

2024 Hanwha Life ESG rating

| Category | Integrated | Environment | Social | Governance |

|---|---|---|---|---|

| KCGS | A | A | A+ | B+ |

| Korea ESG Research Institute | B+ | A | A | B+ |

| Sustinvest | A | - | - | - |

- Sustinvest discloses the integrated rating only

Global Initiatives

As a responsible corporate citizen, Hanwha Life is committed to creating a sustainable society. To this end, we have supported a number of global initiatives, with a view to identifying ESG issues and implementing ESG management.

- Category

- Contents

UNEP FI

(United Nations Environmental Programme Finance Initiative)- Aims to undertake a wide range of programs in partnership with the UNEP and financial institutions, in recognition of the critical role of financial institutions in sustainable development

UNEP FI PSI

(UNEP FI Principles for Sustainable Insurance)- The Principles for Sustainable Insurance declared by the UNEP FI, with a view to identifying, assessing, managing and monitoring the risks and opportunities related to environment, society and governance across the insurance value chain, including interactions with stakeholders

TCFD

(Task Force on Climate-related Financial Disclosure)- A committee established in 2015 by the FSB (FSB, Financial Stability Forum) upon the request from G20, to encourage companies to disclose information related to climate change, including climate- related governance, business strategy, risk management, climate change management targets & indicators, so that companies can effectively incorporate climate-related risks and opportunities into company-wide risk management and decision-making.

UNGC

(UN Global Compact)- The UNGC is the world’s largest voluntary corporate citizen initiative, espousing ten principles in the four areas of human rights, labor, the environment and anti-corruption to be incorporated into business operations and management strategies, in order to pursue sustainable management, enhance corporate citizenship as well as propose practical actions.

UN SDGs

(Sustainable Development Goals)- The UN SDGs were adopted by the 70th UN General Assembly in 2015 under the slogan ‘Leave no-one behind’. This initiative set the direction for the global community in the five areas of Humankind, the Earth, Prosperity, Peace and Partnership, consisting of 17 goals and 169 sub-goals to be achieved by 2030.

CDP

(Carbon Disclosure Project)- The CDP is a global climate change project that urges companies to disclose environmental information such as greenhouse gas emissions, crises and opportunities due to climate change, and carbon management strategies.

PCAF

(Partnership for Carbon Accounting Financials)- PCAF is a global partnership of financial institutions that work together to develop and implement an approach to assess and disclose the GHG emissions associated with their loans and investments. PCAF has developed an open-source global GHG accounting standard for financial institutions, the Global GHG Accounting and Reporting Standard for the Financial Industry.

TNFD

(Taskforce on Nature-related Financial Disclosures)- The Taskforce on Nature-related Financial Disclosures (TNFD) was formally announced in June 2021 to respond to the acceleration of global nature loss and decline. Based the success of the Task Force on Climate-related Financial Disclosures (TCFD), the TNFD aims to put nature at the heart of business decisions to reduce risks to nature and finance.

Sustainability Report

Hanwha Life is publishing Sustainability Report which is aimed at sharing our ESG performance and activities with our stakeholders in a transparent manner.

2025 Sustainability Report

ESG Policies

Hanwha Life's ESG policies support sustainable management.

- Subject

- Attachment

- Corporate Governance Charter

- Guidelines on Board of Directors Independence & Diversity

- Financial Consumer Protection Policy

- Ethics Charter

- Supplier Code of Ethics

- Compliance Program

- Anti-Money Laundering Policy

- Anti-corruption and Bribery Policy

- Privacy Policy

- Human Rights Policy

- Non-Discrimination and Anti-Harassment Policy

- Whistleblower Protections

- Environmental Management Policy

- Safety and Health (OHS) Policy

- Social Contribution

ESG Bond Framework

Hanwha Life Sustainability Bond Framework

- Hanwha Life will use the net proceeds of Sustainability Bond to Green and Social projects. Hanwha Life defines a Framework which is a structure with relevant in Use of Proceeds, Process for Project Evaluation and Selection, Management of Proceeds, and Reporting

- The Framework sets out guidelines for Hanwha Life’s Sustainability Bond issuance in accordance with the 4 components of the International Capital Market Association’s 2021 GBP, SBP and SBG

Framework 4 Components

- 1. Use of Proceeds

The net proceeds of Sustainability Bond will be used to Eligible Projects;

- - Green categories: renewable energy, energy efficiency, sustainable water and wastewater management, pollution prevention and control, green buildings, clean transportation

- - Social categories: access to essential services, affordable housing, socioeconomic advancement and empowerment, accessibility to affordable and quality basic infrastructure

- 2. Project Evaluation and Selection Process

- Hanwha Life's Investment Business Division will manage the net proceeds are allocated to the projects and assets that meet the eligibility criteria as defined above as Eligible Projects

- The Investment Business Division will follow the guideline for ESG-complying investment created by the Investment Committee

- 3. Management of Proceeds

- Hanwha Life's plans to earmark the amount equal to the net proceeds from each issuance and keep track of its allocation

- 4. Reporting

- Hanwha Life's will publish a report on its website annually, up to the point where proceeds will have been fully allocated

Hanwha Life's Sustainability Bond Framework meets the criteria established in the protocol and aligns with the Green Bond Principles 2021, the Social Bond Guidelines 2021 published by the International Capital Market Association. The framework has obtained Second Party Opinion Certification from an independent external institution

Hanwha Life's Sustainability Bond Annual Report

Hanwha Life's intends to publish on its website the Sustainability Bond Annual Report which contains investment information based on the Sustainability Framework until the redemption of the securities.